Powering growth in logistics and transportation

Powering growth in logistics and transportation

Powering growth in logistics and transportation

Our Grow Now, Pay Later credit facility allows businesses to:

Pay bills instantly while spreading out repayments over 1 to 12 months

Pay bills instantly while spreading out repayments over 1 to 12 months

Invest in new projects

Invest in new projects

Improve supplier relationships

Improve supplier relationships

Tailor repayments to your cash flow

Tailor repayments to your cash flow

Trusted by thousands of businesses

Trusted by thousands of businesses

The Funding Gap in Logistics

The Funding Gap in Logistics

The Funding Gap in Logistics

Logistics operators often face lengthy customer payment terms while shouldering high upfront expenses like fuel, vehicle maintenance and driver wages.

Logistics operators often face lengthy customer payment terms while shouldering high upfront expenses like fuel, vehicle maintenance and driver wages.

Seasonality further complicates cash flow planning, making it hard to predict when funding will be needed or how much.

Seasonality further complicates cash flow planning, making it hard to predict when funding will be needed or how much.

Securing funding from traditional lenders can be challenging, given seasonal demand and unpredictable milestone-based contracts.

Securing funding from traditional lenders can be challenging, given seasonal demand and unpredictable milestone-based contracts.

Lenkie ensures you don’t have to choose between growth and cash flow

Lenkie ensures you don’t have to choose between growth and cash flow

Bridge cash flow gaps

Pay suppliers immediately while choosing a flexible repayment period between 1 to 12 months.

Bridge cash flow gaps

Pay suppliers immediately while choosing a flexible repayment period between 1 to 12 months.

Bridge cash flow gaps

Pay suppliers immediately while choosing a flexible repayment period between 1 to 12 months.

Bridge cash flow gaps

Pay suppliers immediately while choosing a flexible repayment period between 1 to 12 months.

Manage funding costs

Usage-based pricing means you only pay for the funding you use, without long-term commitments or hidden fees.

Manage funding costs

Usage-based pricing means you only pay for the funding you use, without long-term commitments or hidden fees.

Manage funding costs

Usage-based pricing means you only pay for the funding you use, without long-term commitments or hidden fees.

Manage funding costs

Usage-based pricing means you only pay for the funding you use, without long-term commitments or hidden fees.

Improve supplier relationships

Pay suppliers on time, negotiate better terms and access early payment discounts.

Improve supplier relationships

Pay suppliers on time, negotiate better terms and access early payment discounts.

Improve supplier relationships

Pay suppliers on time, negotiate better terms and access early payment discounts.

Improve supplier relationships

Pay suppliers on time, negotiate better terms and access early payment discounts.

Access funding to cover:

Access funding to cover:

Warehouse and delivery management software licenses

Warehouse and delivery management software licenses

Staffing and training

Staffing and training

Sales and marketing costs

Sales and marketing costs

Vehicle purchasing and rental

Vehicle purchasing and rental

Fuel and Insurance

Fuel and Insurance

Pay invoices in one click

Pay invoices in one click

Pay invoices in one click

Make payments to 1 supplier, or to 100, in seconds using our bulk payments feature.

Make payments to 1 supplier, or to 100, in seconds using our bulk payments feature.

Make payments to 1 supplier, or to 100, in seconds using our bulk payments feature.

Keep funding discreet

Keep funding discreet

Keep funding discreet

Suppliers see your name on the payment, not ours.

Suppliers see your name on the payment, not ours.

Suppliers see your name on the payment, not ours.

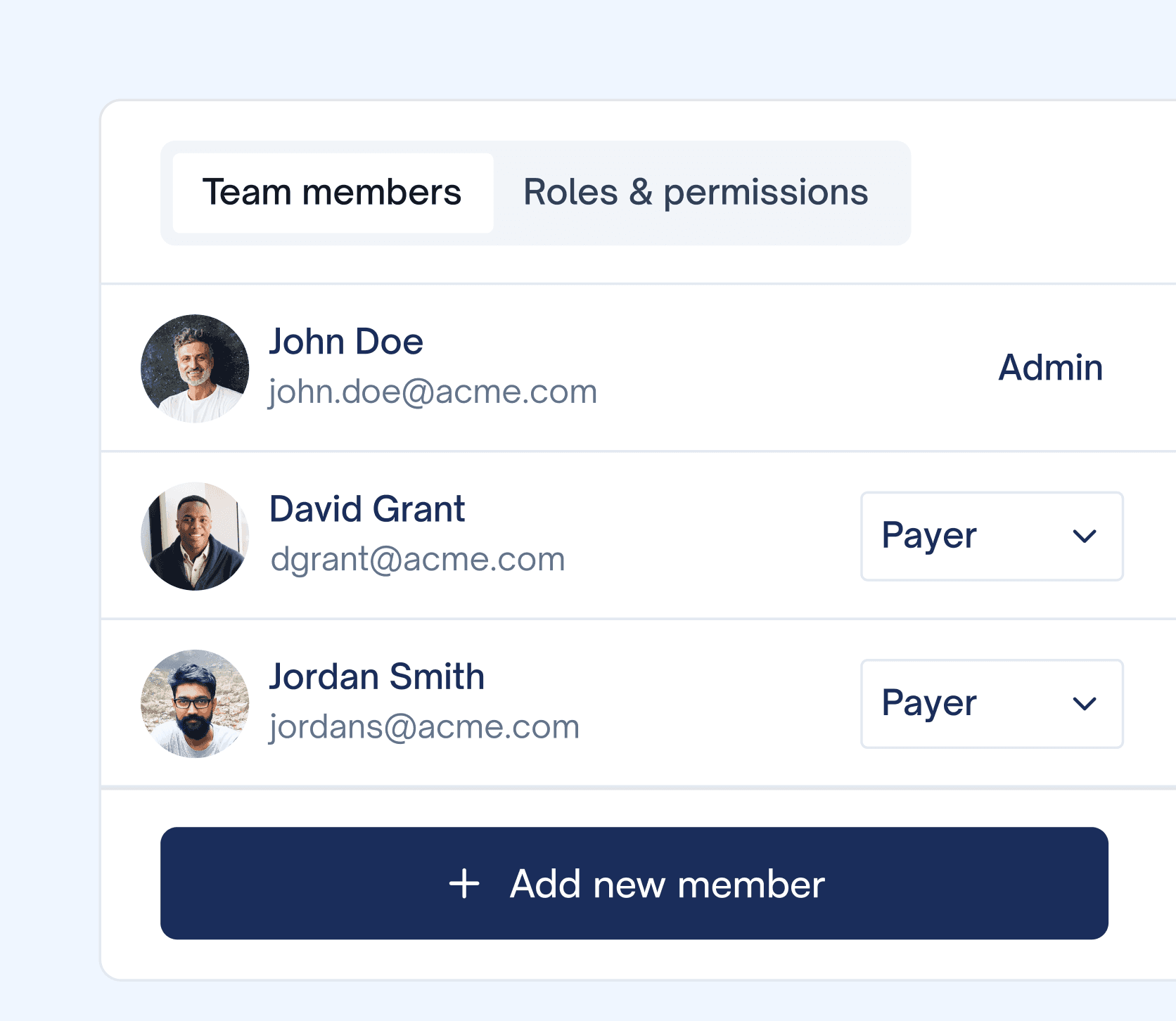

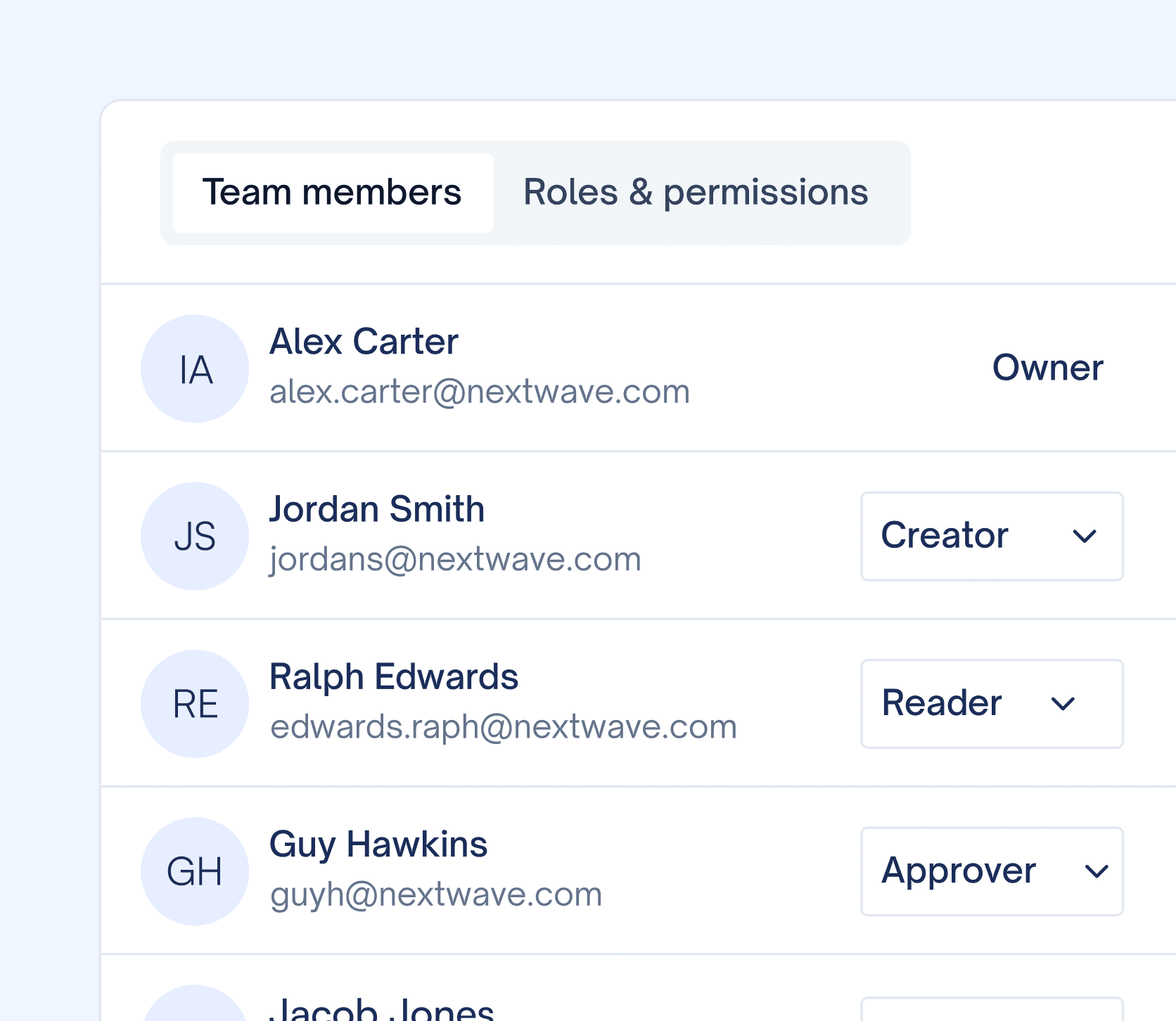

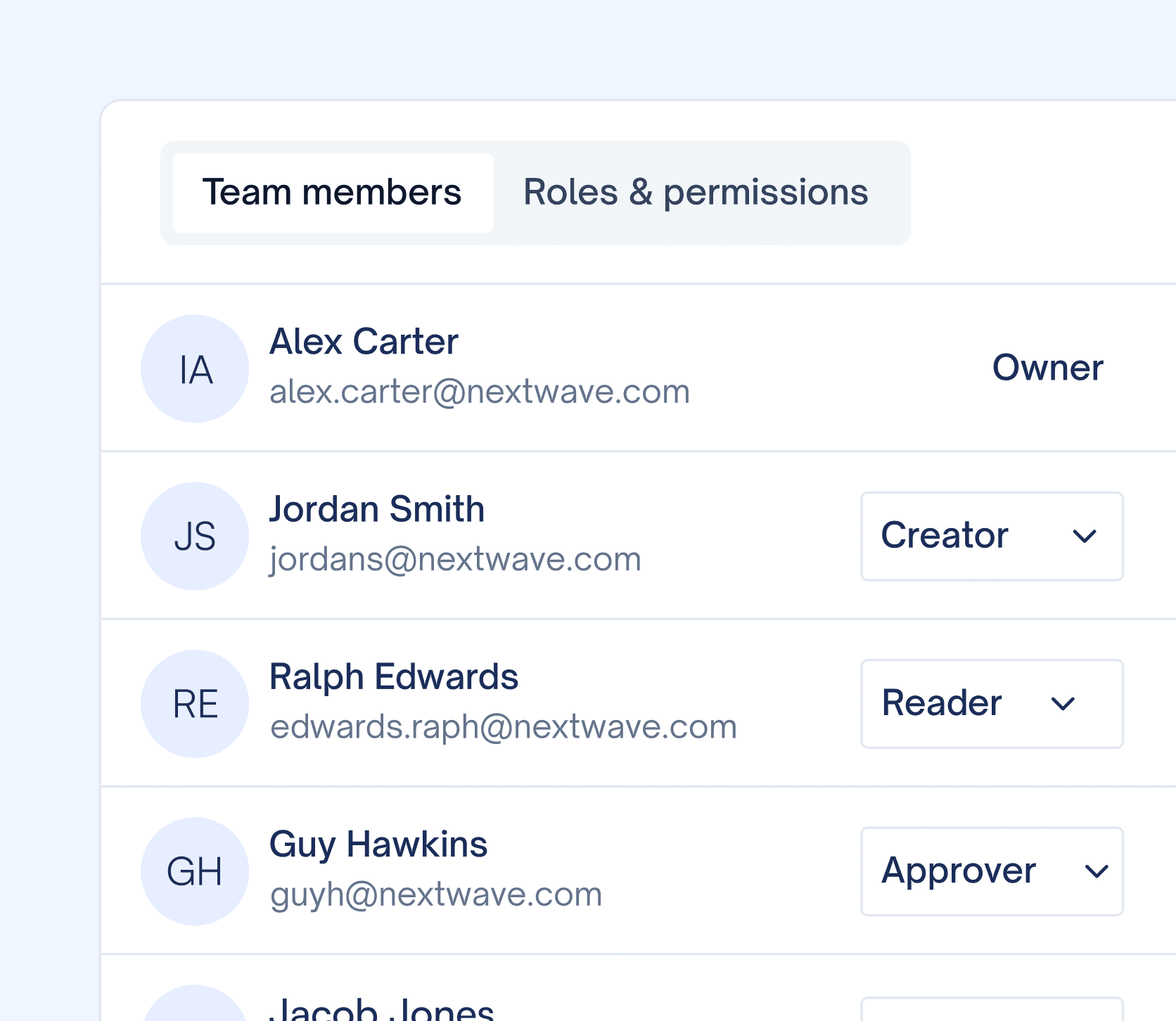

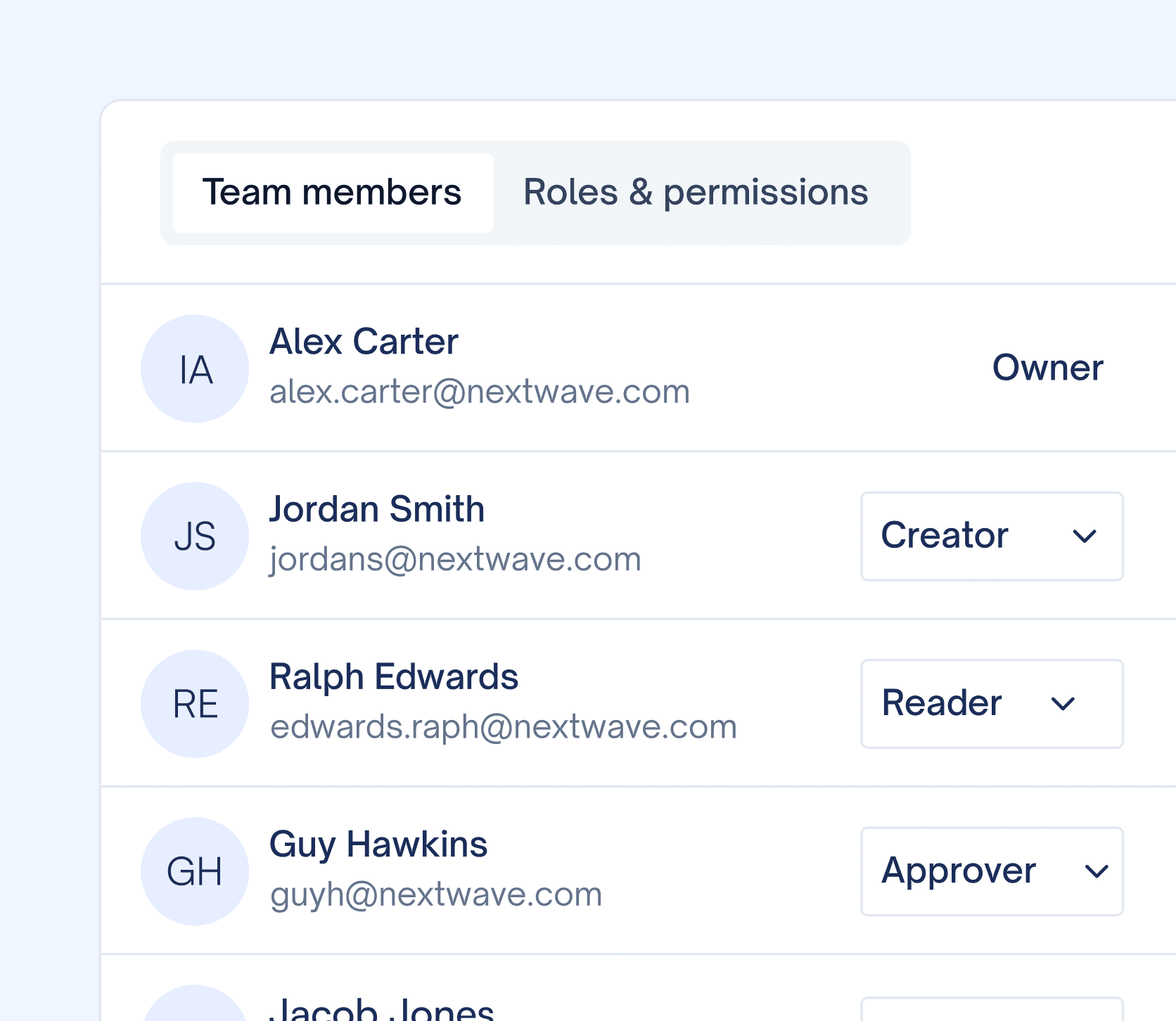

Add your team

Add your team

Add your team

You can add multiple users to the Lenkie dashboard to streamline workflows and increase efficiency.

Use our facility on-site to order stock and materials.

You can add multiple users to the Lenkie dashboard to streamline workflows and increase efficiency.

TrustScore 4.6 • Excellent

Frequently asked questions

Frequently asked questions

What is a Lenkie Credit Facility?

Lenkie provides a credit facility that is specifically designed for working capital expenses i.e. marketing costs, inventory purchases, etc. Our funding enables you to pay these expenses immediately and spread your repayments over 1, 3, 6, 9, or 12 months

What makes Lenkie different from other sources of funding?

How do I apply for a Lenkie Credit Facility?

How quickly can I get approved?

What is a Lenkie Credit Facility?

Lenkie provides a credit facility that is specifically designed for working capital expenses i.e. marketing costs, inventory purchases, etc. Our funding enables you to pay these expenses immediately and spread your repayments over 1, 3, 6, 9, or 12 months

What makes Lenkie different from other sources of funding?

How do I apply for a Lenkie Credit Facility?

How quickly can I get approved?

What is a Lenkie Credit Facility?

Lenkie provides a credit facility that is specifically designed for working capital expenses i.e. marketing costs, inventory purchases, etc. Our funding enables you to pay these expenses immediately and spread your repayments over 1, 3, 6, 9, or 12 months

What makes Lenkie different from other sources of funding?

How do I apply for a Lenkie Credit Facility?

How quickly can I get approved?

What is a Lenkie Credit Facility?

Lenkie provides a credit facility that is specifically designed for working capital expenses i.e. marketing costs, inventory purchases, etc. Our funding enables you to pay these expenses immediately and spread your repayments over 1, 3, 6, 9, or 12 months

What makes Lenkie different from other sources of funding?

How do I apply for a Lenkie Credit Facility?

How quickly can I get approved?

Grow Now, Pay Later

Access instant funding to supercharge your growth

lenkie

London, United Kingdom

hello@lenkie.com

020 4587 0937

© 2024 Lenkie technologies. All rights reserved.

Grow Now, Pay Later

Access instant funding to supercharge your growth

lenkie

London, United Kingdom

hello@lenkie.com

020 4587 0937

© 2024 Lenkie technologies. All rights reserved.

Grow Now, Pay Later

Access instant funding to supercharge your growth

lenkie

London, United Kingdom

hello@lenkie.com

020 4587 0937

© 2024 Lenkie technologies. All rights reserved.

Grow Now, Pay Later

Access instant funding to supercharge your growth

lenkie

London, United Kingdom

hello@lenkie.com

020 4587 0937

© 2024 Lenkie technologies. All rights reserved.