The ultimate credit facility for your clients

The ultimate credit facility for your clients

The ultimate credit facility for your clients

The ultimate credit facility for your clients

Lenkie has funded thousands of UK businesses who have optimised their cashflow with our credit line to pay suppliers, vendors, business expenses and subcontractors. We work with hundreds of brokers to support their clients paying invoices now, and spread repayment terms for up to 12 months.

Lenkie has funded thousands of UK businesses who have optimised their cashflow with our credit line to pay suppliers, vendors, business expenses and subcontractors. We work with hundreds of brokers to support their clients paying invoices now, and spread repayment terms for up to 12 months.

How it works

How it works

Sign up in 2 minutes

Submit applications

Invite your client to sign-up

Track your client’s progress

Manage your commission

Limits that grow with your client

Limits that grow with your client

Limits that grow with your client

We support funding limits up to £1,000,000. With your client’s growth and ongoing facility usage, their limit can increase over time.

We support funding limits up to £1,000,000. With your client’s growth and ongoing facility usage, their limit can increase over time.

We support funding limits up to £1,000,000. With your client’s growth and ongoing facility usage, their limit can increase over time.

Repayments tailored to their business

Repayments tailored to their business

Repayments tailored to their business

With Lenkie, your client can split bills into manageable monthly instalments spread over over 1 to 12 months. They choose the terms that best suit their business.

With Lenkie, your client can split bills into manageable monthly instalments spread over over 1 to 12 months. They choose the terms that best suit their business.

Use our facility on-site to order stock and materials.

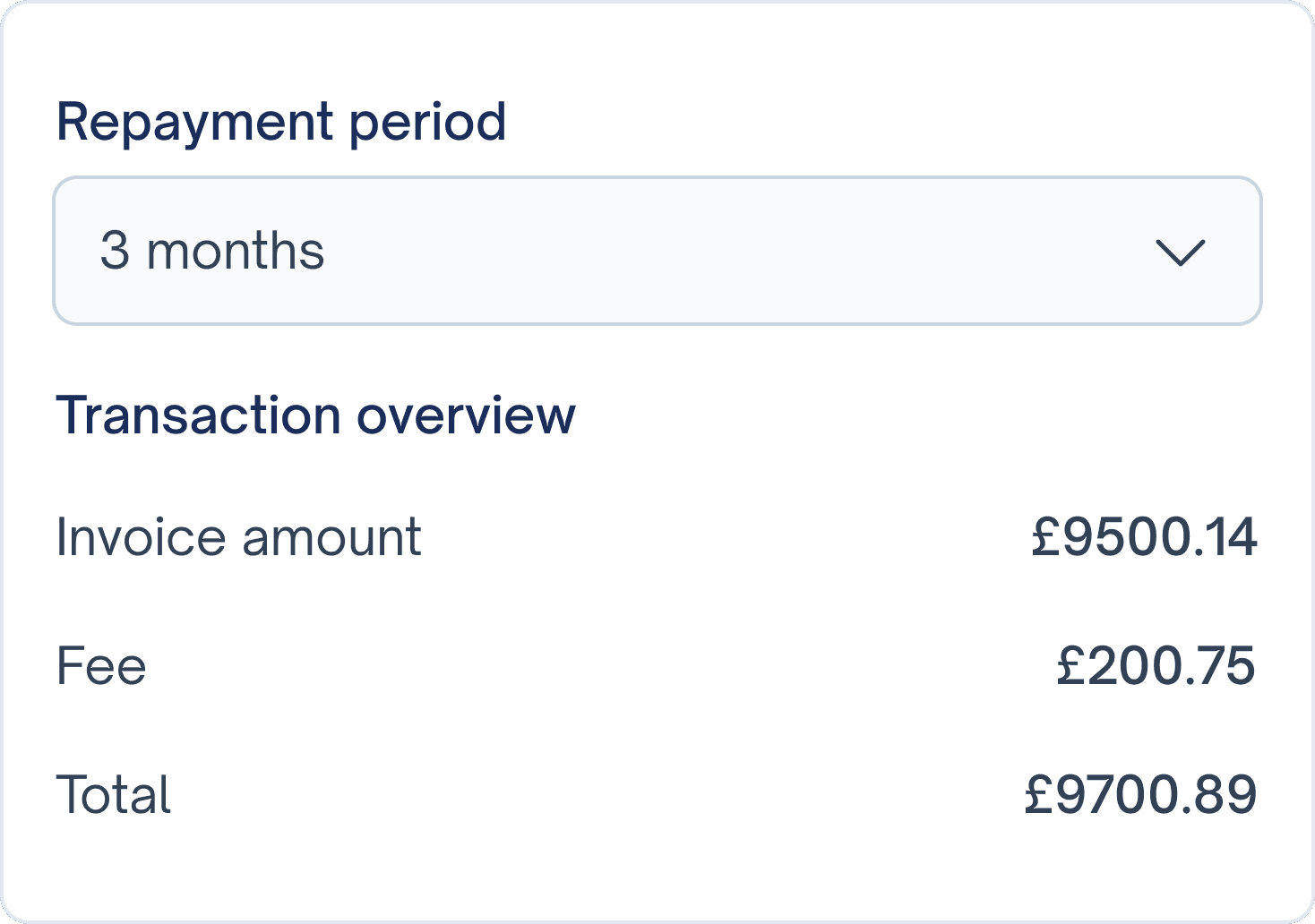

Clear and transparent pricing

Clear and transparent pricing

Clear and transparent pricing

We charge a single fee for each payment based on the invoice size and chosen repayment period. Having a facility costs nothing, so your client will only ever pay for what they use.

We charge a single fee for each payment based on the invoice size and chosen repayment period. Having a facility costs nothing, so your client will only ever pay for what they use.

We charge a single fee for each payment based on the invoice size and chosen repayment period. Having a facility costs nothing, so your client will only ever pay for what they use.

Revolving balance

Revolving balance

Revolving balance

Each repayment tops up your client’s available balance, allowing them to access a continuous line of credit without needing to re-apply.

Each repayment tops up your client’s available balance, allowing them to access a continuous line of credit without needing to re-apply.

Each repayment tops up your client’s available balance, allowing them to access a continuous line of credit without needing to re-apply.

Your client can upload and pay supplier invoices in seconds. It’s that simple.

Your client can upload and pay supplier invoices in seconds. It’s that simple.

Pay suppliers immediately

With same-day payments in GBP, USD and EUR to over 150 countries, suppliers will receive funds immediately wherever they are.

Pay suppliers immediately

With same-day payments in GBP, USD and EUR to over 150 countries, suppliers will receive funds immediately wherever they are.

Reconcile payments easily

Our Xero or Quickbooks connections allow your client to import bills and reconcile payments automatically.

Reconcile payments easily

Our Xero or Quickbooks connections allow your client to import bills and reconcile payments automatically.

Pay multiple invoices in one click

Pay invoices to suppliers in seconds with our bulk pay feature.

Pay multiple invoices in one click

Pay invoices to suppliers in seconds with our bulk pay feature.

Pay multiple invoices in one click

Pay invoices to suppliers in seconds with our bulk pay feature.

We stay behind the scenes

Suppliers see your client’s name on the payment, not ours.

We are fully confidential

We stay behind the scenes

Suppliers see your client’s name on the payment, not ours.

We are fully confidential

Get the right funding for

your client's business

Get the right funding for

your client's business

Get the right funding for

your client's business

Lenkie’s Grow Now, Pay Later credit facility is designed for businesses that:

Lenkie’s Grow Now, Pay Later credit facility is designed for businesses that:

Are UK-based and operate as a limited company or LLP

Are UK-based and operate as a limited company or LLP

Have at least £1,000,000 in annual revenue based on your latest filed accounts

Have at least £1,000,000 in annual revenue based on your latest filed accounts

Have been trading for at least 18 months

Have been trading for at least 18 months

Unsure if we’re a good match or want to chat? Contact our team here. Even if our funding solution isn’t right for you, we have an extensive partnership network that’ll be happy to help.

Unsure if we’re a good match or want to chat? Contact our team here. Even if our funding solution isn’t right for you, we have an extensive partnership network that’ll be happy to help.

* This limit calculator is for illustrative purposes only and is not a formal funding offer for your business. For a formal offer, you must first a submit an application. If approved, your limit may vary depending on Lenkie’s full underwriting review.

Grow Now, Pay Later

Access instant funding to supercharge your growth

Apply now

lenkie

London, United Kingdom

hello@lenkie.com

020 4587 0937

Grow Now, Pay Later

Access instant funding to supercharge your growth

Apply now

lenkie

London, United Kingdom

hello@lenkie.com

020 4587 0937

Grow Now, Pay Later

Access instant funding to supercharge your growth

Apply now

lenkie

London, United Kingdom

hello@lenkie.com

020 4587 0937