GROWTH CAPITAL

We provide funding from £5k to £250k to spend on marketing, inventory or

just growing your business.

Apply for funding Supercharge your Growth

Growth Capital is a fast and flexible alternative funding option that's tailored to your business. This cash advance is designed to accelerate business growth, allowing you to invest in your business through marketing campaigns, inventory upgrades, or by smoothing out your cash flow. Get a quick decision with no effect on your credit score when you apply through Lenkie.

Speed

3 minute application and 24 hour funding decision.

Transparency

One flat fee starting at 6% - no hidden costs.

Flexibility

Revenue based financing means you repay as a percentage of your sales.

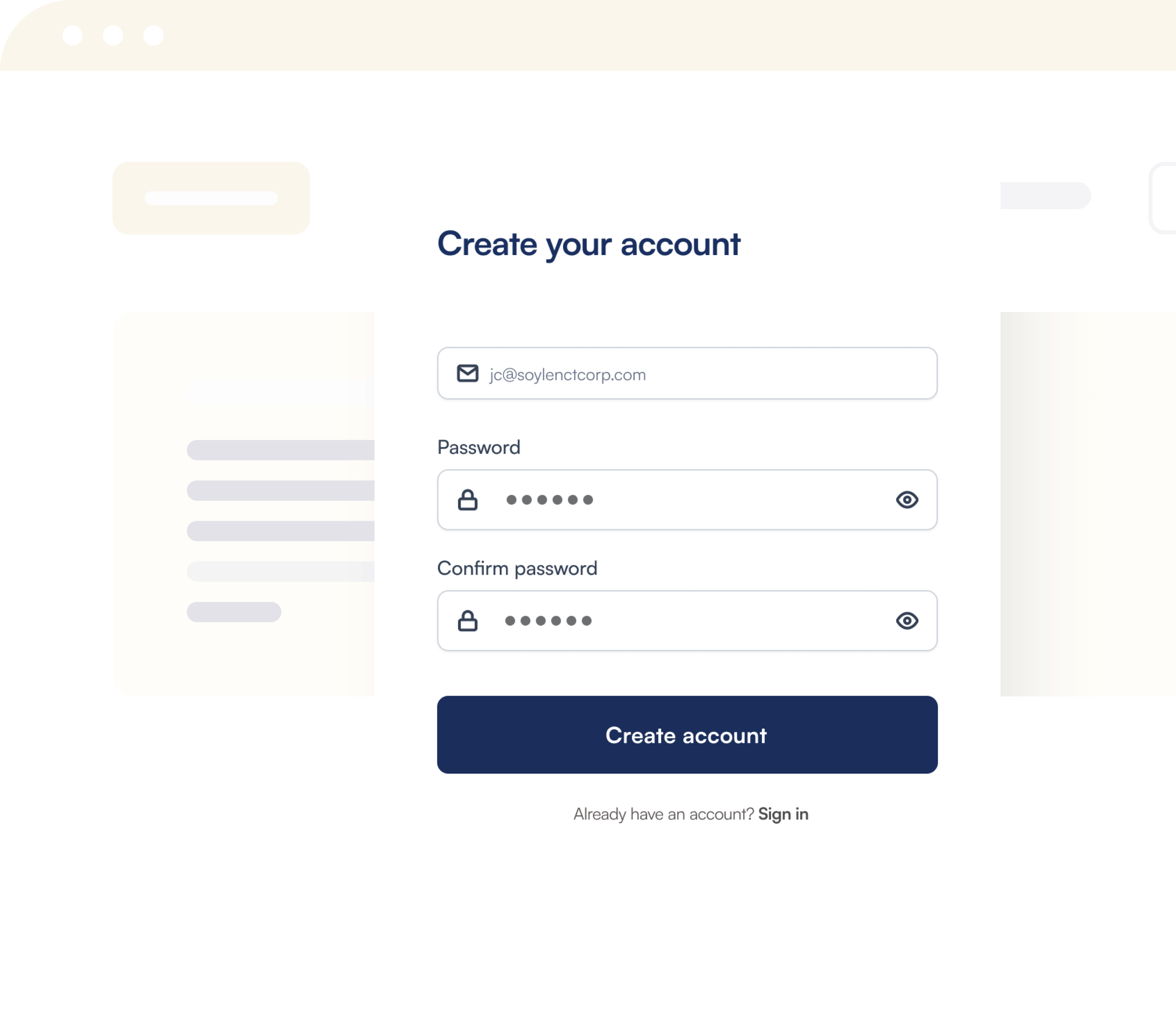

Create an account

Choose and accept your offer

Receive cash as soon as the next day

Make repayments based on sales

Flat fee starting from 6%

Disclaimer: This calculator is for illustration purposes only.

Find out how much you could borrow with our business funding calculator. Just use the slider to compare your business’ approximate monthly income and the amount you could be funded.

Apply for fundingLoved by

Lenkie has been a great way for our business to attract extra capital, so we can plan ahead, buy more inventory and grow faster.

Joppe Coelingh Bennink

Co-Founder, Yop and Tom

Contact us

We’d love to hear from you. Fill out this form and we’ll follow up.

hello@lenkie.com

Phone

Mon-Fri from 8am to 5pm.

+44 (0)20 4587 0937

Text

Mon-Fri from 8am to 5pm.

+44 (0)77 2356 6364