Published on 10th August, 2022

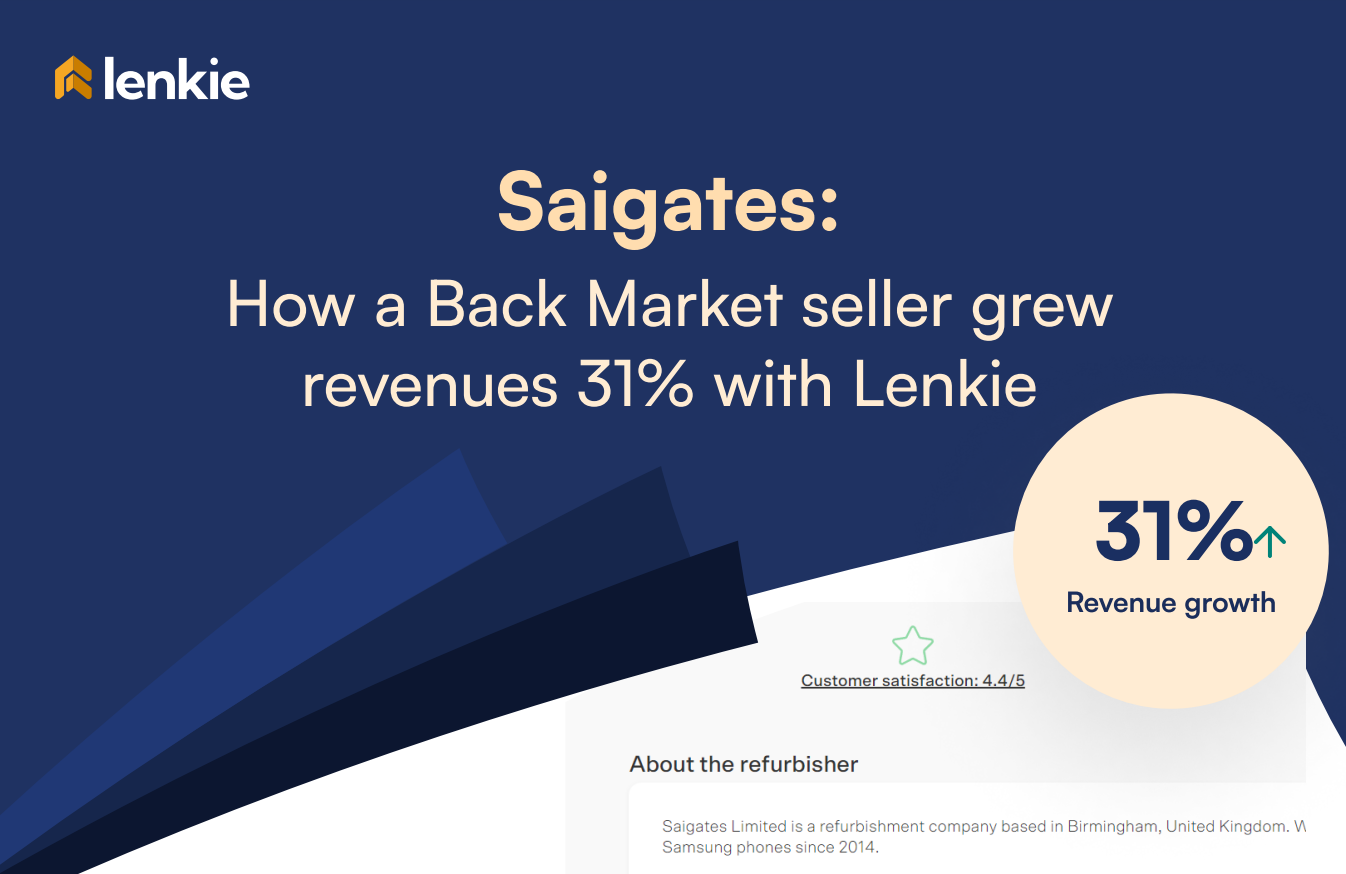

Saigates: How a Back Market seller grew revenues 31% with Lenkie

About Saigates

In 2014, Sagar founded Saigates in Birmingham, UK. His business sells refurbished electronics across online marketplaces such as Back Market, Amazon, and eBay. Since 2021, Saigates has been rapidly scaling and has effectively capitalised on the growing demand in the refurbished electronics market. Sagar identified a shift in the market towards business models that reduce e-waste and encourage reuse, so he wanted to provide more affordable electronic devices for those working and learning remotely.

The Challenge - Meeting customer demand

Sagar saw massive demand for his refurbished electronics on the platform Back Market. However, his main bottleneck was his stock; he was frequently selling out of key units which affected the volume of listings he was able to maintain online. In the past, Sagar accessed alternative growth funding, but now he wanted a more affordable and flexible option, a solution that would take Saigates to the next level in terms of sales volume. If Sagar could secure enough inventory, then Saigates could scale and fulfil its growth potential.

Our Solution - Growth Capital

Lenkie’s team identified Saigates as a fast-growing business with tremendous potential and after finding out that Lenkie specialises in lending to Back Market sellers, Sagar applied online in just 3-minutes! Within 24 hours of sharing his business data, Sagar received multiple bespoke funding offers and was approved for £100,000. The capital was immediately used to order inventory at scale and also acquire higher-quality devices at lower prices. As a result, device return rates decreased by 24%.

So far Saigates’ revenue has increased by 31% within the first month and customer demand currently shows no sign of slowing down.

“Lenkie’s application was straightforward, the decision was fast, and the team was very responsive - I had used other financing before, but with Lenkie, I was able to buy inventory within days of applying.”

Sagar expressed a slight concern that his sales might slow down during the summertime (common for electronics refurbishers) but Lenkie provides flexibility in repayments. As such, his repayments will change in line with his revenue, so if sales slow down, repayments will decrease accordingly. This enables Sagar to have more working capital available when he needs it most.

Funding longer-term growth

Sagar plans on utilising some of the Growth Capital to increase his brand awareness by running marketing campaigns to drive more customers to his Back Market page. Looking further ahead, Lenkie plans on providing Saigates with additional funding in Q4 2022 to fully maximise sales during the Black Friday and Christmas period.

Are you interested in funding to accelerate your business growth? Apply here - it’ll take you less than 3 minutes!